The decision on double cab pickups - Company cars or vans?

HMRC has this week introduced new guidance surrounding the tax treatment of double-cab pickups and whether they can be defined as company cars or vans.

This distinction is incredibly important due to the very different tax charges that arise when these employer-provided vehicles are available for private use, as well as for capital allowances purposes.

Previously, (6 April 2002 to 30 June 2024) when deciding whether double cab pickups count as company cars or vans, HMRC used the definitions in line with those of VAT. This meant that if the pickup had a payload of 1 tonne or more, the vehicle would be defined as a van and therefore any insignificant amounts of private use would not generate a taxable benefit. Double cab pickups are those with a second row of seats behind the driver. They have been a popular choice for employees due to their versatility of use, enhanced by the tax benefits, and have (until now) been a much cheaper option than a company car.

However, from 1 July 2024, HMRC will no longer interpret the legislation in line with VAT purposes, instead the classification of double cab pickups will be determined by assessing the vehicle as a whole and whether its construction has a primary suitability for the conveyance of goods. Consequently, from the 1 July 2024 most, if not all, double cab pickups will be classified as company cars when calculating the benefit charge, due to them being equally as suited to transporting passengers as they are for the conveyance of goods.

This new guidance follows years of questions and debate following the judgment reached by the Court of Appeal in the infamous Coca Cola case, which saw double cab pickups being classed as company cars due to their availability as a multi-purpose vehicle.

What does this mean for you as an employee?

This means that any double cab pickups purchased after 1 July 2024 (see transitional arrangements below if you have already purchased, leased, or ordered a double cab pickup) will now give rise to a benefit in kind and this benefit will become chargeable to income tax at either 20%, 40% or 45% depending on whether you are a basic rate, higher rate or additional rate taxpayer.

Previously, double cab pickups with a payload of 1 tonne or more were treated as vans, meaning that a benefit would only arise if an employee was given unrestricted private use. In this case the benefit, subject to income tax, would be a fixed amount of £3,960. Similarly, if free or subsidised fuel was given for private use, the fixed benefit amount would be £757, leading to a maximum income tax liability of £2,123 if taxed at the 45% rate.

Any incidental private use would not have incurred a benefit charge, and no tax liability would have arisen on the employee.

However, due to the new guidance, the benefit arising on double cab pickups will now be calculated using the company car and fuel benefit rules which are significantly higher. These apply when a car is ‘made available’ for private use and, unlike with vans, there is no exemption for incidental or insignificant private use.

The amount of benefit is based on several factors including list price and Co2 emissions. At a high level the benefit is the list price multiplied by the relevant percentage that is determined by the Co2 emissions.

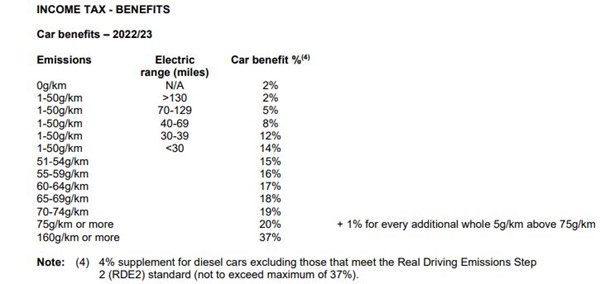

The relevant percentages are currently frozen at the following values:

As you can see the lower the Co2 emissions, the lower the percentage. The percentage for electric vehicles is determined by its range.

There is also a 4% supplement for some diesel cars.

Example:

If you were given a double cab pickup, that was available for private use with a list price of £30,000 and Co2 emissions of 180g/km. The benefit arising would be £11,100 (30,000 x 37%), leading to a tax liability of £4,440 at the higher rate (‘HR’) or £4,995 at the additional rate (‘AR’).

If fuel is also provided for private motoring, the taxable benefit is £27,800 x 37% (based on Co2 emissions), meaning for the example given above an additional benefit of £10,286 would arise, giving a tax liability of £4,114 (HR) and £4,629 (AR).

Therefore, for a vehicle previously treated as a van with incidental private use, the above example shows an additional tax liability of £8,554 (HR) and £9,624 (AR). This is a significant additional cost for employees, decreasing their take home pay.

What does this mean for you as an employer?

Previously, where no taxable benefit arose, there would be no National Insurance implications nor any administrative responsibility to report anything to HMRC. However, if a benefit now arises, the employer will need to report the benefit amount on a P11D(B) form and prepare the supporting P11D form for the employee and submit these to HMRC by 6 July following the end of the tax year.

The employer will then need to pay Class 1A national insurance contributions on the benefit amount, currently at a rate of 13.8% to HMRC, by 19 July.

Again, using the example above, the additional Class 1A NICs would be £2,951. This is deductible for corporation tax purposes, meaning that a company paying corporation tax at the full rate of 25% would suffer a net overall tax cost of around £2.2K. As noted above, there will also be additional administrative costs in reporting the benefit to HMRC.

Capital allowances

HMRC have also confirmed that the changes will apply to capital allowances claims.

Currently, double cab pickups are generally treated as commercial vehicles for capital allowance purposes. This means that they are eligible for the 100% Annual Investment Allowance ('AIA') and also potentially for 100% ‘Full Expensing’ relief, and so businesses are normally able to claim full relief for the cost of the vehicle in the year of acquisition.

However, from 1 July 2024, most double cab pickups will be treated as ‘cars’ for capital allowance purposes and it will take a lot longer for business to claim full relief. This is because capital allowances are far less generous for cars than for commercial vehicles. Cars do not qualify for the AIA nor for Full Expensing relief. The rate at which capital allowances are claimable for cars is determined by the Co2 emissions of the vehicle. Cars with emissions of 50g/km are eligible for allowances of 18% per year, whereas those with over 50 g/km are only eligible for 6% per year. As these allowances are given on a ‘writing down basis’ it can take many years for full relief to be obtained. Only new and unused electric cars/ cars with zero emissions are eligible for 100% relief in the year of acquisition.

This is another change which will make most double cab pickups far less attractive for businesses.

VAT

For VAT purposes, the definition (noted above) remains unchanged. Therefore, businesses acquiring double cab pickups from 1 July 2024 will still be able to reclaim the VAT on purchase, provided that the vehicle meets the requirements in line with HMRC’s interpretation of the legislation.

However, it is worth noting that HMRC are starting to ask the question on a case-to-case basis whether the primary use of the double cab pickup is business or private use. In the case of this being the latter, HMRC could look to claw back a proportion of the VAT re-claimed on the purchase of the vehicle.

Transitional arrangements

Due to the substantial tax implications of this new guidance, HMRC have stated that employers who have purchased, leased, or ordered a double cab pickup before 1 July 2024 can rely on the previous treatment until the earlier of the disposal of that vehicle, or 5 April 2028. However, this has only been confirmed to be true when calculating the benefit charge, meaning that double cab pickups, no matter when they are purchased, could no longer be entitled to AIA or full expensing for capital allowances purposes.

Therefore, if you already use a double cab pickup that qualifies as a van on the pre 1 July 2024 rules, the new guidance will not affect you straight away. There is still time to order a double cab pickup and have access to the existing tax advantages (although there may be a large queue to join), giving you time to seek advice and plan ahead.

Will this affect sole traders and partners?

Although benefits in kind are only relevant for employers and employees, the new guidance will affect the capital allowances treatment for sole traders and/or partners. (See capital allowances section above.)

Should you have any concerns or questions regarding the reporting of car or van benefits to HMRC or would like some advice on how to prepare for the new guidance please contact our tax team at Rickard Luckin.

If you have any questions about the above, or would like more information specific to your circumstances, please enter your email address below and we will get in touch: